The Auto Body Association of Texas’ number one priority is and always will be consumer safety. Sometimes that safety is physical and sometimes it is protection of their rights. We stand up for shops and the consumer alike to make sure that auto body repair is safe, proper and fair. Here is what we are working on at the capitol:

The Fair Appraisal Bill addresses the consumers’ right to a fair appraisal in the instance that a body shop and an insurance company cannot agree on the terms of a repair bill. The consumer has a right to hire and appraiser who will work with the insurance company’s appraiser to come to an agreement. Two Insurance companies in Texas have submitted policies that OMIT the customer’s right to invoke their right appraisal. We are working to preserve this right for Texas consumers.

The Safe Auto Repair Bill, addresses many issues repairers face but mostly the need for reimbursement for following OEM procedures, and the safety of aftermarket parts. This is NOT an anti-aftermarket bill- we just want these parts to be safety tested and truly be of “like kind quality” as it pertains to fit, finish, function, and above all else- crashworthiness. The bill also addresses steering, database manipulation and the insurers’ disregard of repair operations or procedures outlined in the estimating system or Procedure Pages.

Right to Appraisal data and overview

The need for the Texas mandatory Right to Appraisal for the insured has never been more critical than it is today. In the last several months, Progressive and Home State County Mutual Insurance have submitted policy change applications to the Texas Department of Insurance, requesting approval to remove the right to appraisal for repair procedure disputes from their policies. Many general agencies, such as Kemper, Aspen, and Direct General, write coverage under Home State County Mutual. Progressive and Home State County Mutual rescinded their application request this past week.

Please read the following article from Texas Automotive Magazine:

WHY DO WE NEED MANDATORY RIGHT TO APPRAISAL IN TEXAS?

Appraisal is the guardrail for indemnification of the loss when a dispute arises between the insurer and the insured. Without legislation requiring mandatory time-sensitive appraisal rights, we can expect to see continued efforts by all insurers to limit or remove economic relief for the insured when it comes to under-indemnification of a covered loss. In this respect, the insurance carrier can best be seen as a mama bear protecting her cubs and will fight anyone trying to take them away. Once they see the insured getting some economic relief for their loss, they quickly act to prevent the insured from getting such relief. Mandatory right to appraisal would stop this atrocity.

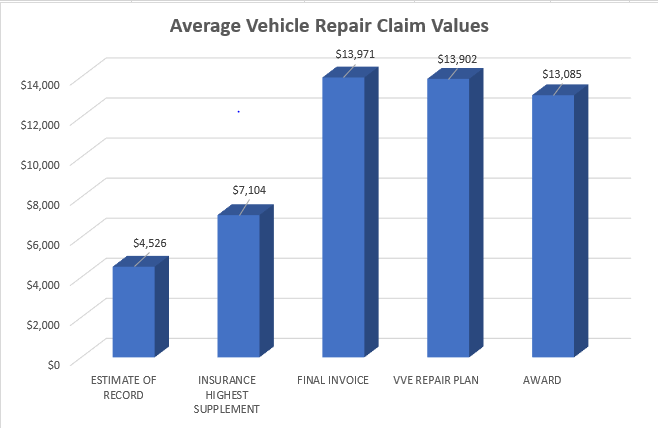

Below are the average results that Auto Claim Specialists has achieved for their clients who have come to them for help with the under-indemnification of their repair procedure loss. These averages do not include the hundreds of claims they have moved to the judicial process. These numbers are only for claims that they have invoked the right to appraisal for their clients, and the insurance carrier honored the contractual policy right of appraisal to resolve the dispute.

TEXAS REPAIR PROCEDURE RIGHT TO APPRAISAL NON-LITIGATION AVERAGES

Date of Loss to Filed ROA: 99 Days

Filed ROA to Date Appraiser Appointed: 70 Days

Date Appraiser Appointed to Date Settled ROA: 103 Days

Average Insurance Estimate of Record: $4,558.23

Average Insurance Highest Supplement: $7,132.31

Average Collision Facility Final Invoice: $13,959.73

Average Vehicle Value Experts Repair Plan: $13,884.47

Average Appraisal Award: $13,055.60

TEXAS REPAIR PROCEDURE NON-LITIGATION UNDER-INDEMNIFICATION GRAPH

TEXAS REPAIR PROCEDURE NON-LITIGATION CYCLE TIME GRAPH

Under-indemnification in repair procedure claims in Texas is rampant. Most of the above-referenced averages on estimates and supplements had many overlooked (By Design) safety and OEM-required operations needed to restore the loss vehicle to its pre-loss condition to the best of ones human ability. Besides the higher settlements we have obtained for our clients, on average, for total loss clients, we increase their settlement by $4,200.00 or 28% above the carrier’s undisputed loss statement. These under-indemnification percentages are staggering and harmful to Texas citizens. Limiting or removing the insured right to appraisal of a repair procedure is a safety issue. Limiting or removing the right to appraisal by the carrier in a repair procedure dispute will be the nail in the coffin for safe roadways in Texas.

WHY WE NEED A MANDATORY RIGHT TO APPRAISAL

We need every Texan to help stop the insurance carrier under-indemnification scheme and pass a Texas Mandatory Right to Appraisal Bill this upcoming legislative session.

The Office of Public Insurance Counsel (OPIC) has made a recommendation that legislature be passed to INCLUDE the right to appraisal in every insurance policy in Texas.

Read the full recommendation report HERE.